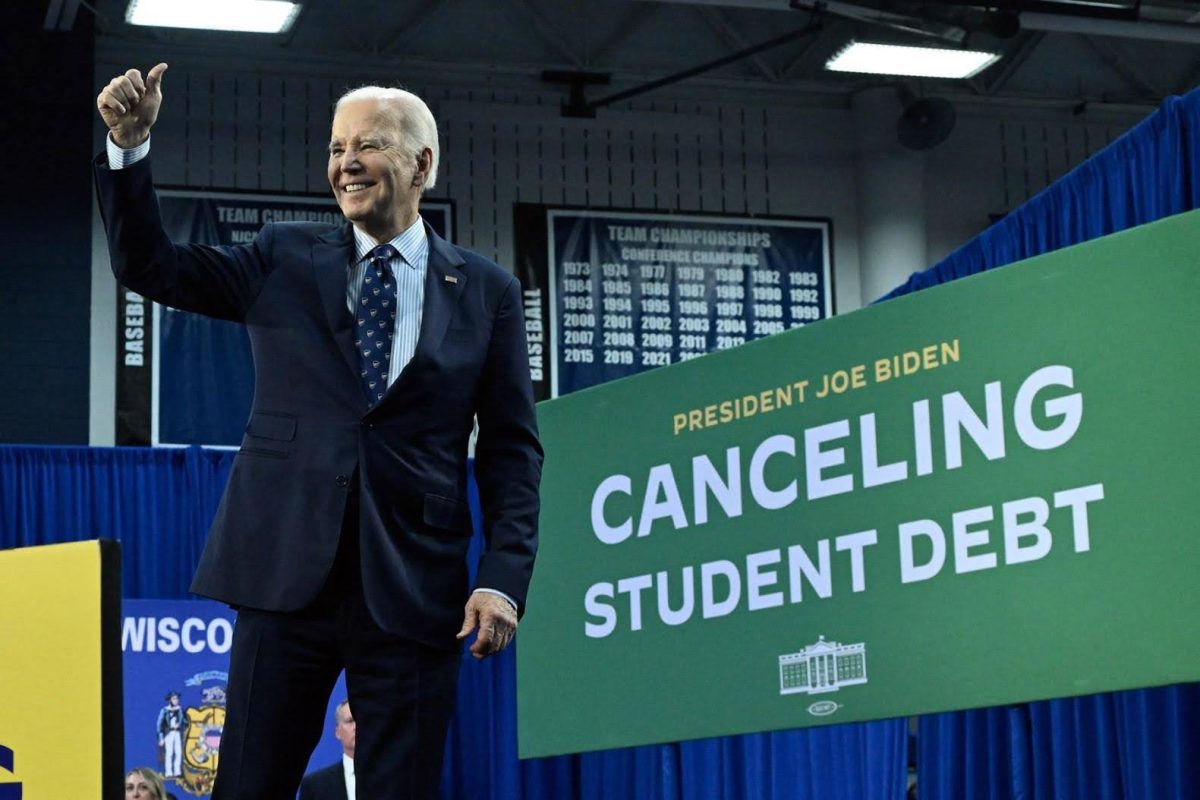

Bridgewater, VA – The Biden administration has put together a new plan that would terminate student debt for millions of Americans. If the plan is implemented, there would be more than 30 million people with some or all of their student loan debt forgiven, according to Sequoia Carrillo.

Biden made it clear in his presidential campaign back in 2020 that student loan debt relief would be a focus of his presidency. The Biden administration tried to implement a student loan debt forgiveness plan last summer, however, the Supreme Court rejected the plan because a combination of Republican-led states and conservative organizations filed a lawsuit against the Biden administration, contending that the executive branch lacks the authority to extensively cancel student debt as outlined in the proposal.

The second revision of this plan looks more promising. The plan targets relief to specific groups of people who have carried debt for many years and are struggling to make their payments. Regardless of income, anyone who has student loan debt could see relief due to high interest balances.

According to Katie Lobosco, if this plan is implemented, borrowers could see debt relief if they fall into any of these categories: People who have balances bigger than what they originally borrowed due to interest; those who already qualify for student loan forgiveness under existing programs that have not applied; people who entered repayment at least 20 years ago; those who enrolled in “low financial value” programs, which left students in debt but without good job prospects; and people experiencing financial hardship.

If the plans are approved as they are proposed, there would be no application needed by anyone. The Department of Education plans to use data they already possess to automatically credit people’s accounts. However, there would be a different program implemented for people who are struggling with medical debt or childcare that would require an application.

It is expected that the new plan will take time before eligible people receive the benefits of the debt relief. The Department of Education must gather public comments on the proposal before releasing the finalized plan.

The final revision will likely run into legal problems as well, but the Biden administration is confident this plan has stronger legal ground than the first debt relief plan.